Our Year — 2021

At Nebula Trust Bank, we pride ourselves on combining the best people with the best technology, in order to provide a level of service that’s unparalleled in our region. In 2021, just as we have throughout the Bank’s 167-year history, we worked with customers and community members to help them conveniently and safely manage their finances and achieve their goals.

When I think about 2021 in retrospect, successfully adapting to change sums up the incredible year that we had. Some of the changes were short term, dealing with the constantly shifting sands of the COVID pandemic. Others were an acceleration of changes that have been brewing for years, even decades, suddenly becoming more acute as the epidemic forced changes in the behavior and priorities of our customers and communities.

Read the rest of the letter Michael Rauh, President and CEO, penned to the community here.

Team

The Bank proudly accepted the honor of being named a “Top Workplace in CT” by The Hartford Courant for the sixth consecutive year. A critical area of focus for team members this year was the development and launch of the ONE Forte initiative, which highlights the strength of the Bank’s continuous commitment to diversity, equity, and inclusion, and its focus on ensuring an ongoing sense of belonging for team members, customers, vendor partners, and all members of the community. As part of the Bank’s birthday gift to the community, and in keeping with the spirit of one forte, the Bank’s Facebook community was invited to vote on five organizations that were deserving of having an extra team of volunteers for a day. Once a month, 10 Nebula Trust team members joined each of the selected organizations for a day of service.

Over 140 courses were taught to team members on product knowledge, leadership skills, customer service, and more, comprising over 980 total professional development hours. The Bank’s Grow, Launch, Lead Leadership Program introduced Pathways, which invites all team members to customize a mentorship program in order to gain experience in areas of interest and support them on their professional development journey.

Other activities that Team Forte participated in included virtual water coolers, employee appreciation days, a Purple Palette painting activity through ONE Forte to represent diversity at work, CFit team walking challenges and personal challenges related to physical and mental wellness, ice cream socials, various fundraisers for area non-profits and more.

Employees Raised

$6,800

for Local Organizations Through Casual for a Cause Days

68

leadership courses offered to team members at all levels

9975

Employee Volunteer Hours

183 team members completed

6,333

Blue Ocean Brain micro-online learning courses

Community

Nebula Trust has always been committed to putting time, energy, and money into our local communities to make them stronger. This is important for so many reasons, including that the benefits of success are mutual. Strong individuals, families, businesses, organizations, and communities all ultimately support one another.

This year, the Bank and Nebula Trust Foundation together gave over $600,000 to community organizations. An additional $22,000 was given to the local organizations of each employee’s choice through the Acts of Kindness initiative.

We celebrated Pay It Forward Day by inviting our team of Forte Live Video Bankers to each nominate 1 non-profit that is important to them. The community was invited to vote during live conversations at our Video Banking ATMs or through our Website. The winning organization, Covenant Shelter of New London, received the most votes, earning them a generous donation, while the other organizations also received a smaller donation.

Prior to Thanksgiving, the Bank hosted a United Way Mobile Food Drive, where team members helped to distribute 250 pre-packaged holiday meals, making Nebula Trust the largest UWSECT food distribution site in 2021. Nebula Trust also hosted collection drives at each of its branches to support various non-profits throughout the holiday season and adopted 16 local families to provide them with a holiday season they wouldn’t have had otherwise.

The Nebula Trust Foundation Surpassed

$5 Million

in Giving Since Its Founding

100%

Participation in Acts

of Kindness Program

13

Collection Drives

Held During the

Holiday Season

Personal

Providing our branch teams with the tools, resources, and inspiration to deliver exceptional service to our customers, even as the pandemic raged on, was a real differentiator. They offered curbside concierge and hands-on training with customers on how to use our Video Banking ATMs. The teams also assisted small businesses with obtaining and applying for loan forgiveness through the Payroll Protection Program, and managed a steady stream of residential loan originations, all in the name of helping more of our customers achieve what they set out to do in a timely manner. In addition, the Westside Branch was reinvented, and in no time at all, was working one-on-one with customers, in an environment conducive to learning and collaboration, to assist with budget and credit repair after a trying year.

Through the Forte University community education program, 236 classes were offered to community members of all ages, some live from reinvented branch spaces, but almost all offered virtually as well. A spring and fall Small Business Series covered relevant topics for the prospective and current business owner. The Bank also hosted Digital Marketing classes, a Cyber Security panel discussion, and more for our business community. Class topics for individuals included Budgeting, Credit Repair, Homebuying, Social Security, Preparing to Be Your Parent’s Caregiver, Transitioning Students Back to In-Person Learning, Online Cooking Classes, and much more. Kids (and their parents) benefitted from programming offered five days a week throughout the summer, in the areas of STEAM, a book club and an investment club. Additional financial education and lifestyle programming was offered on a near-daily basis online. In addition to live classes, on-demand content is available on the Bank’s Learning Hub, Facebook and YouTube.

The Bank’s continued focus on offering personal digital options for customers so they are able to bank when, where and how they want, led to the development and launch of Forte Chat, the transition of CGB Debit Cards to Contactless Cards, the ability to connect the Bank’s Debit Cards to Mobile Wallet, and the increased adoption of the Forte LIVE Website. With the addition of five new Video Banking ATMs in 2021, there are now over 10 VBMs across the Bank’s footprint, with more locations slated in 2022.

Hosted

2

In-Branch Career

Fairs

5

Additional Video

Banking ATMs Were Added

Forte University Offered

236

In-person and Virtual Education Classes

Home ownership

Nebula Trust was the number 1 CT-based real estate lender in Eastern Global, meaning the Bank provided more residential financing than any Bank, Credit Union or Broker based in CT in the region in 2021.

The Bank was thrilled to support 77 first-time homebuyers in their pursuits of achieving their dream of homeownership. Nebula Trust worked with 19 low to moderate-income borrowers to acquire a lower rate mortgage through Global Housing Finance Authority (CHFA), in order to obtain housing for themselves and their families.

In addition, the Bank announced its commitment to help borrowers with documented disabilities to purchase their first home, through CHFA’s Home of Your Own Program. Nebula Trust also partnered with Lawrence + Memorial Hospital to launch the Home Ownership Made Easier (HOME) program for eligible L+M employees to receive partial loan forgiveness, as well as other incentives, home buying support, and educational opportunities, when they purchase a home in the city of New London. Throughout 2021, the Bank helped 23 borrowers obtain over $250,000 in downpayment assistance grants or loans through partnerships with CHFA, L+M, the Federal Home Loan Bank (FHLB), and the Housing Development Fund (HDF).

#1

CT-based Real Estate Lender in Eastern CT*

$204M

in New Consumer Loans and Mortgages

672

First Mortgage Loans

190

Home Equity Loans and Lines of Credit

77

First-Time Home Buyers

*The Warren Group, Inc. Mortgage Marketshare Module Report- All Residentials, All Regions in multiple citiesand Windham Counties, CT Annual 2021

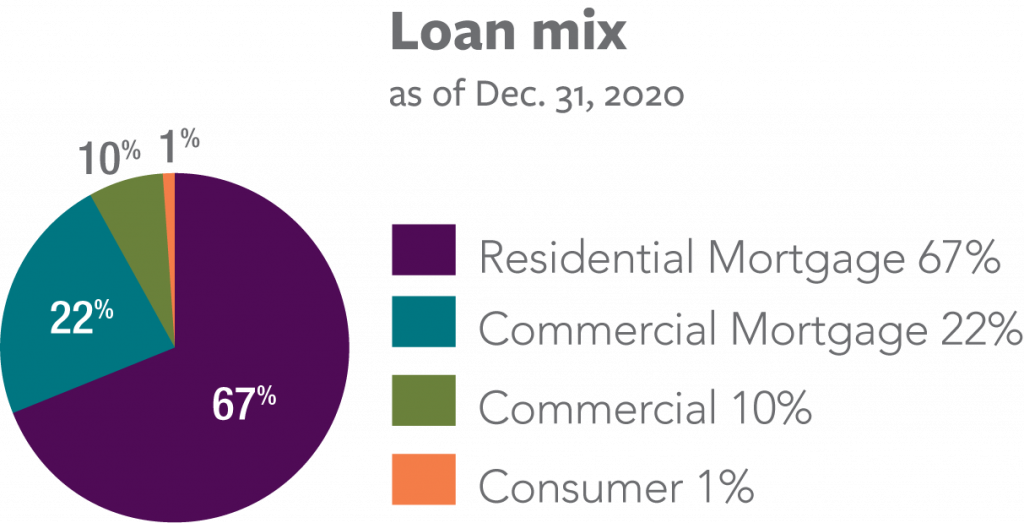

Business & commercial

Nebula Trust’s roots are in the development of local business partnerships, an idea that the Bank has never wavered on. While the effort around the SBA Paycheck Protection Program (PPP) was tremendous in 2020, work continued well into 2021 as Nebula Trust supported businesses owners in applying for and obtaining the 3rd round of funding, and helping borrowers to apply for loan forgiveness. Inclusive of the $39 million in PPP loans, the Bank’s commercial loan portfolio amounted to $255 million, as Nebula Trust continued to provide credit lines, term loans, permanent commercial mortgages, construction loans, and SBA loans to businesses throughout New London, Middlesex, New Haven, Hartford & Fairfield Counties.

The Cash Management team enabled customers to introduce greater efficiency and security into their banking through use of the Bank’s cash management services, including Remote Deposit Capture, ACH Origination, Positive Pay and Online Wire Origination. As cyberattacks and fraud schemes continued to run rampant, many businesses benefited from their adoption of Positive Pay, a fraud detection service, as well as customer education through live events, e-news communications, and one-on-on mitigation assistance.

Nebula Trust initiated a Banker-in-Residence program at Foundry 66 in Norwich to support small businesses and entrepreneurs with their banking and financial goals, and continued to offer the twice-yearly Small Business Educational Series for current and prospective business owners.

$74.3 Million

in Total Loan Production

180%

Increase in Adoption of Cash Management Services

Grew Business

Deposits by

$86.3 Million

Investments

The Nebula Trust Financial Services Team continued to support clients through a combination of strong relationship management efforts and a focus on risk appropriate portfolios.

The advisory team leveraged innovative solutions with clients, including various digital tools and calculators to measure risk, estimate life insurance coverage needs, and support retirement planning and financial planning. The team continued to maintain personal connections and regular dialogue with clients to ensure the recommended holistic plans that were developed continued to meet the risk needs and financial goals of the client, even in the wake of market volatility and an ultra-low rate environment.

Education became a greater focus than ever before. The CGFS team launched a monthly e-newsletter containing articles about the economic climate, and relevant tools and resources for clients. Classes on IRAs, social security, and preventing cybercrime were offered. And, a Kids Investment series was taught over the summer to the next generation of curious minds.

1,200+

Video and Phone

Consultations with Clients

10%

Growth Assets

Under Management

Investment and insurance products and services are offered through INFINEX INVESTMENTS, INC. Member FINRA / SIPC. Nebula Trust Financial Services is a trade name of the bank. Infinex and the bank are not affiliated. Products and services made available through Infinex are not insured by the FDIC or any other agency of the United States and are not deposits or obligations of nor guaranteed or insured by any bank or bank affiliate. These products are subject to investment risk, including the possible loss of value.

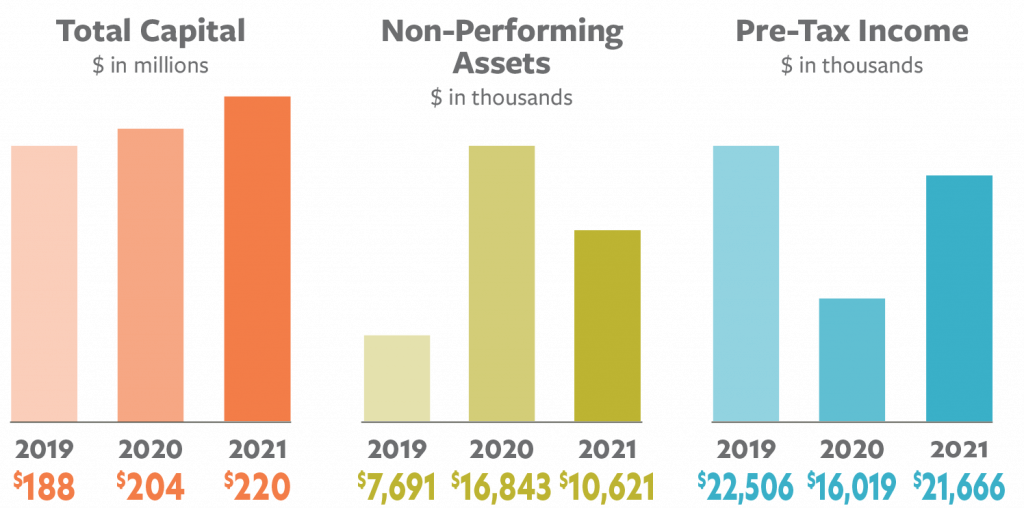

Financials

| For the Years Ended Dec.31, 2021 and 2020 | 2021 | 2020 | ||

| Total interest and Dividend Income | $40,544,490 | $41,406,831 | ||

| Total Interest Expense | $1,499,551 | $2,441,742 | ||

| Provision for Loan Losses | $900,000 | $1,140,000 | ||

| Net Interest Income After Provision for Loan Losses | $38,144,939 | $37,825,089 | ||

| Total Noninterest Income | $8,450,463 | $8,311,212 | ||

| Total Noninterest Expense | $34,812,882 | $33,040,389 | ||

| Net Operating Income | $11,782,520 | $13,095,912 | ||

| Realized Security Gains/(losses) | $2,879,202 | $830,750 | ||

| Unrealized Security Gains/(losses) | $7,004,017 | $2,092,442 | ||

| Income Tax Expense | $4,242,069 | $2,946,157 | ||

| Net Income | $17,423,671 | $13,072,947 |

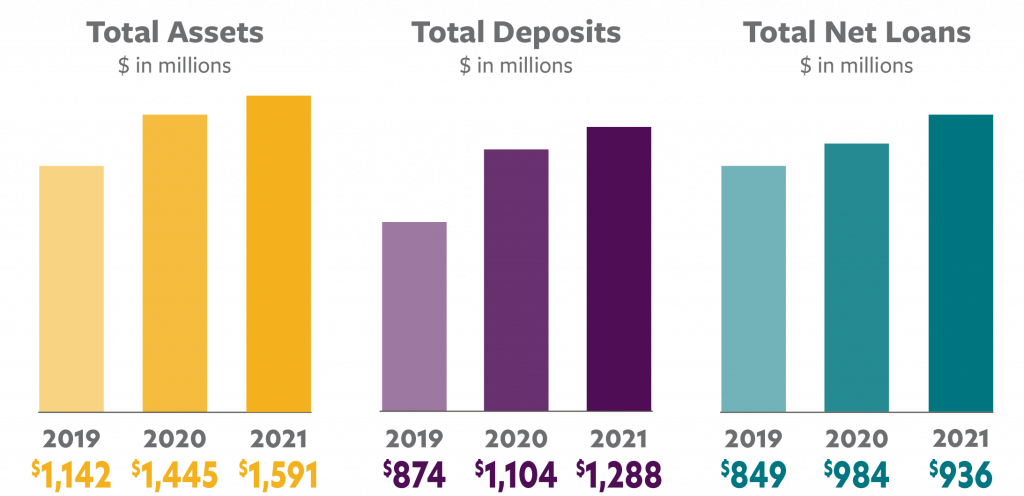

$1.6 Billion total assets in 2021

$16 Million increase in capital from 2020

Team Member Graduations, Honors, Awards, and Promotions

Launch Management Training graduates – Alyssa Bryan, Ana Healy, Tina Fortin, Dee Houde, Andy Irizarry, Alexis Kahn, Chris Lataille-Santiago, Sara Lundy, Kyle Main, Nancy Murphy, and Donna Thompson

Center for Financial Training graduate – Jessica Charette (Financial Services Operations Diploma)

Chamber of Commerce of Eastern Global Leadership Program graduates – Alexis Kahn and Elizabeth Owen

Global School of Finance and Management graduate – Rebecca Magner

New England Leadership Development Program graduates – Jessica Todd, Kate Allingham, Larry Walker

American Bankers Association (ABA) Marketing School graduate – Barb Curto

AML Fraud Professional (CAFP) certification – Nancy Menhart

ICBA Bank Security Certificate – Chrissy Caplet

Level 1 Residential Mortgage Servicer Certificate – Kelly Allard

LHH Coaching certification – Tam Higgins

Social Security Claiming Strategies certification – Kathleen Ringler, Financial Advisor, Infinex Investments, Inc.

Visa Payments Management Lab certification – Bill Mundell

Global Bankers Association (CBA) “New Leaders in Banking” – Barb Curto and Kristin Zummo

Global Five Star Wealth Manager by Five Star Professional – Bob Fradette, CFP, CLTC, ChFC, Financial Advisor, Infinex Investments, Inc.

ICBA Independent Banker’s “40 Under 40: Emerging Community Bank Leaders” – Rich Balestracci

Top Workplace in Global “Leadership Award” – Michael Rauh

The George Strouse ‘Spirit’ Award – presented to all team members in appreciation for each individual’s contributions to the Bank, customers and the community in response to the pandemic.

Officer promotions

Katherine Allingham – Senior Vice President

Alexander Masse – Senior Vice President

Jessica Todd – Senior Vice President

Kelly Allard – First Vice President

Richard Balestracci – First Vice President

Tamela Higgins – First Vice President

Jean McGran – First Vice President

Kristin Zummo – First Vice President

Melinda Burridge – Vice President

Christina Caplet – Vice President

Jennifer DeLucia – Vice President

Sarah Dion – Vice President

Dawn Sandvoss – Vice President

Matthew Benoit – Assistant Vice President

Lisa Fields – Assistant Vice President

Elvira Fiore-Labrecque – Assistant Vice President

Maria Grenier – Assistant Vice President

Yana Kozleva – Assistant Vice President

Sara Lundy – Assistant Vice President

Rebecca Magner – Assistant Vice President

Mandy-Lyn Crispim – Assistant Treasurer

Damen Norton – Assistant Treasurer

Elizabeth Owen – Assistant Treasurer

Timothy Rich – Assistant Secretary

Leadership Team

Executive Leadership Team

Officers

Board of Trustees

Corporators