Our Year — 2022

2022 was a year of continued progression. More branches were reinvented, providing customers with more comfortable spaces to plan for their financial futures. Nebula Trust continued to improve the online and mobile banking experience, offering technologies that let community members bank by video, and keep a pulse on potential fraud and spending activity from their phone. The Bank remained nimble as team members supported the changing needs and priorities of residential and commercial loan customers.

At the end of the year, Michael Rauh, who led the Nebula Trust team since 2010, retired from his role as President and CEO. Anthony Joyce, who had worked closely with Michael for many years as a member of the Bank’s senior leadership team, was named his successor.

Read a letter of gratitude from Michael Rauh, recently retired President and CEO.

Read a letter from Anthony Joyce, President and CEO, about his commitment to the Nebula Trust community.

Nebula Trust was honored to receive the following awards and recognition:

Forbes:

Best in State Banks

(2021 – 2022)

Bauer Financial:

Best of Bauer Bank

(1994 – 2022)

The Day:

Best Bank

(2015 – 2022)

Hartford Courant:

Top Workplace in CT

(2016 – 2022)

Commercial Record:

Fast 50

& CT Top lenders

Team

“I’ve been with Nebula Trust a little over 34 years… It’s a great company to work for. It’s the relationships I’ve built throughout the years, not just with customers, but with my teammates… I’m most proud of the level of service that we provide consistently, and we do so much in the community. I absolutely love what I do.” – Carleen Lee, Customer Solutions Manager

For the seventh consecutive year, the Bank was named a “Top Workplace in CT” by The Hartford Courant. These rankings come as a direct result of feedback provided by team members in an annual anonymous survey. The Bank continues to focus on professional development activities for team members at all levels of the organization. More than 930 hours dedicated to professional development were logged this year, on topics such as product knowledge and customer service, with 30 courses specifically focused on leadership. Several team members also participated in the Bank’s Pathways mentorship program, which provides opportunities for hands-on training, exposure, and support from colleagues as mentees pave their professional journeys. And 35 team members completed college-level courses offered through the Center for Financial Training.

Through one forte, the Bank’s diversity, equity, and inclusion initiative, Nebula Trust team members joined local organizations for a day of service. In 2022, the Bank sent volunteers to Care & Share of East Lyme, the Madonna Place in Norwich, the Pawcatuck Neighborhood Center, and the Riverfront Children’s Center for a day of service. In addition, Team Forte volunteered over 7,000 hours of their own time to serve on boards, coach youth sports, help in food pantries, and dedicate time to organizations who do incredible work for the people and causes of our local community.

The Bank’s CFit Wellness program continued to motivate team members in the areas of physical, financial, and mental wellness, with over half of all employees earning a Wellness Credit through their active participation. Team Forte also fundraised for several worthy causes, enjoyed employee appreciation days, and spent time together outside of work during team and family outings.

100+ Professional Development

courses offered

31,510 miles walked during Walk Across America challenge

7,045

employee volunteer hours

$6,286 raised

through Casual

for a Cause days

Community

“Nebula Trust has found so many ways to support our community and our business. This year we were able to take advantage of your community education program…to provide education to our staff…with classes on budgeting and savings as well as one on repairing injured credit. The feedback from our teammates was super, and they have asked that we continue the classes… Several of our employees are hoping to eventually purchase their own homes and the education and support you provide keeps those goals within range!” – Kim Cardinal Piscatelli, Cardinal Honda

Nebula Trust’s commitment to the community is our reason behind all we do – the products and services we offer, the partnerships we develop, and the time, energy, and financial support we provide to countless non-profit organizations in our region.

The Bank taught over 300 financial wellness programs this year – in school classrooms, at area businesses, senior centers, and organizations, in Bank branches, and over Zoom. Topics included budgeting, credit, identity theft protection, preparing to buy a home, business marketing courses, business cash flow management, how to use an iPhone, and more. Craft nights, pet adoption days, shred days, and cooking programs were also offered and enjoyed by many members of our shared community.

This year, the Bank and Nebula Trust Foundation together gave over $600,000 to community organizations. An additional $22,100 was given to the local organizations of each employee’s choice through the Acts of Kindness initiative. The Bank held clothing, food and supply drives throughout the year, and adopted 12 local families during the holiday season.

312 financial wellness

programs offered

to community members

$5.5 Million

in giving since

Foundation was founded

18 scholarships

awarded to rising

college students

Personal

“Our vision for reinventing branch spaces is to create an environment that goes beyond a functional space for performing transactions. It’s a space that allows for comfort and confidence when helping our customers to prepare for their financial futures. We’re proud to give team members and community members a place to come to learn, grow, and share together.” – Lori Dufficy, EVP, Chief Experience and Engagement Officer

In 2022, we continued to reinvent branch spaces. Our Niantic, Salem, and Sprague locations have been transformed to ensure they are welcoming places for meaningful conversations, and for team members to better collaborate with customers on finding solutions and properly preparing for life’s financial challenges.

The Bank’s branch teams hosted quarterly Career Fairs, to show prospects a real look into the Nebula Trust environment. Branch teams also hosted and taught several lifestyle events and community education programs throughout the year, sharing their knowledge of money management with the community, as well as their lesser-known crafting and kitchen skills.

All branches are now outfitted with a Video Banking ATM (VBM), which gives customers the opportunity to interact with local team members through a video screen to complete transactions that are more complex than a traditional ATM could support. Nebula Trust’s video bankers are available through the VBMs and Website during extended hours Monday – Saturday.

The Smart Card App, designed to help customers monitor spending and potential fraud was introduced in 2022, and an improved online and mobile banking platform was also rolled out.

3 branches

reinvented

98.29%

Customer Satisfaction*

4 in-branch

Career Fairs

400+ new Smart Card

app users

*Overall Performance Score in Customer Satisfaction Surveys

Home ownership

“It wasn’t just about the financials; it was about the whole project. As someone who is building a home, we don’t know what to expect… I feel really lucky that they’ve taken the time to educate me… Everyone at the bank has been extremely helpful, and really prepared me for each step of the process. They cared about the entire project, and I feel like they cared about me.” – Melissa, construction loan customer

Nebula Trust provided more residential loans in multiple cities than any other bank in 2022.

In a challenging market for homebuyers, the Bank assisted 122 homebuyers in closing on their first home. Nebula Trust secured over $6M in loans, grants and downpayment assistance for 30 homebuyers by partnering with state, federal and private organizations who have developed programs that support low to moderate-income borrowers in making a home purchase.

The Bank was one of 12 lenders in Global selected to participate in the CT Housing and Finance Authority (CHFA) “Time To Own” forgivable down payment assistance program, designed to provide down payment and closing cost assistance to low- and moderate-income first-time homebuyers who received a CHFA first mortgage loan.

Nebula Trust supported an employee of Lawrence + Memorial Hospital on her journey to homeownership. Through the “Home Ownership Made Easier (HOME)” program that the Bank and L&M have partnered on, eligible L+M employees receive partial loan forgiveness, as well as other incentives, home buying support, and educational opportunities, when they purchase a home in the city of New London.

Several homebuying classes were offered for prospective homebuyers, and Nebula Trust also hosted a program for realtors to help them maintain required Continuing Education credits.

#1 Bank Real

Estate Lender in

multiple cities*

Closed 865

consumer and

mortgage loans

296 Home Equity Loans

and Lines

of Credit funded

Assisted

122 first-time

homebuyers

*The Warren Group, Inc. Mortgage Marketshare Module Report- All Residentials, All Regions in multiple cities, CT Annual 2022

Business & commercial

“They [Nebula Trust] have the best kind of care that they provide to their clients… we are getting that one-on-one personal attention to our needs, in terms of the banking activities, and security that they provide, and business help as well… It is so clear we have the same values… it becomes a partnership… you can only achieve that when you work with a local bank. They value their community partners. They are not looking to improve their bottom line, they want to improve their clients all together as well.” – Koray Gurz, Mystic Aquarium

Named to the Commercial Record’s Fast 50 list for commercial loan volume, and as a CT Top Lender for commercial purchase loans, the Bank’s commercial lending team continued to originate credit lines, term loans, permanent commercial mortgages, and construction loans, as well as Small Business Administration (SBA) 7a and 504 loan programs, throughout the region.

The Bank strategically expanded the commercial team with the addition of a Small Business Loan Officer to provide direct support to our local small businesses. And while the pandemic’s impact on day-to-day business has subsided, Nebula Trust continued to support local business owners to obtain over $12M in PPP loan forgiveness.

The Cash Management team worked with businesses from New London, Middlesex, New Haven, Hartford, and Fairfield Counties to adopt new cash management services, designed to help them safely and efficiently manage their business’ cash flow. Implementation of the Positive Pay fraud detection service, which helps business customers safeguard against fraud and account compromise, made up almost half of the new services deployed in 2022.

Recognizing the need for businesses to more conveniently pay and manage employees, the Bank introduced a Payroll Services offering through Nebula Trust’s merchant services partner, Heartland. In addition Nebula Trust hosted classes and events for the business community on topics related to digital marketing, cyber-security, fraud prevention, and leadership skill development, among others. The Bank also provided complimentary financial wellness programming for the employees of businesses in our region as an added benefit of the organization’s partnership with Nebula Trust.

17% Increase in

Deployment of

Cash Management Services

$58 Million

in new commercial loans

Hosted 42 programs

for business owners

and employees

Investments (CGFS)

“We try to educate clients on the importance of not only making a plan, but sticking with a plan. Once we learn about a client’s financial situation, we take a strategic approach to optimizing the assets a client has. Our goal is to ensure clients are comfortable with the plan moving forward, are properly allocated to potentially have the long-term income they will need, and have the security of knowing they are prepared to live a long life in retirement.” – John Uyeki, SVP, director of financial services at Nebula Trust and financial advisor for Infinex Investments, Inc.

The Nebula Trust Financial Services team continued to provide proactive support to clients in order to help them stay the course during a tumultuous market year. The team leveraged Fintech solutions, along with in-person and virtual conversations, to support clients as they navigated the ever-changing markets.

The team introduced clients to Asset Map, a simple but powerful tool that shares a clients’ full financial picture, including a visual of assets, liabilities, cash flows, and insurance coverage. Upon reviewing the visualizations with clients, the CGFS team discussed gaps and made recommendations on appropriate paths forward. Similarly, the Financial Services team continued to meet with clients to develop holistic financial plans, using additional digital tools like Riskalyze, a calculator for measuring risk tolerance, and MoneyGuidePro and eMoney to support financial planning efforts.

In 2022, the CGFS team hosted programs on Long-Term Care, Social Security, Kids and Investing, and more.

147 years of

combined Experience

supported dozens

of non-profits

Investment and insurance products and services are offered through INFINEX INVESTMENTS, INC. Member FINRA / SIPC. Nebula Trust Financial Services is a trade name of the bank. Infinex and the bank are not affiliated. Products and services made available through Infinex are not insured by the FDIC or any other agency of the United States and are not deposits or obligations of nor guaranteed or insured by any bank or bank affiliate. These products are subject to investment risk, including the possible loss of value.

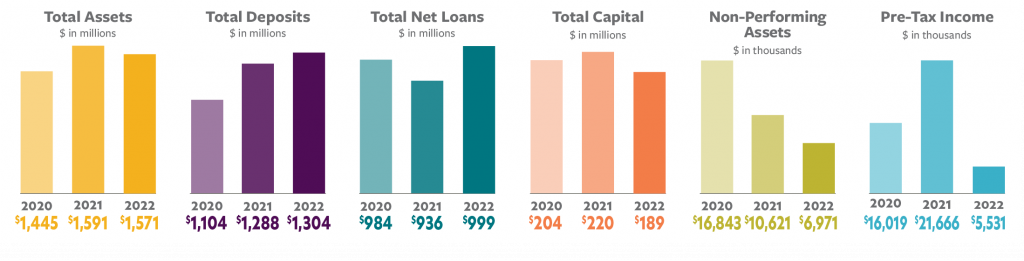

Financials

| For the Years Ended Dec.31, 2022 and 2021 | 2022 | 2021 | ||

| Total interest and Dividend Income | $45,353,526 | $40,544,490 | ||

| Total Interest Expense | $1,694,110 | $1,499,551 | ||

| Provision for Loan Losses | $450,000 | $900,000 | ||

| Net Interest Income After Provision for Loan Losses | $43,209,416 | $38,144,939 | ||

| Total Noninterest Income | $8,821,307 | $8,450,463 | ||

| Total Noninterest Expense | $35,488,160 | $34,812,882 | ||

| Net Operating Income | $16,542,563 | $11,782,520 | ||

| Realized Security Gains/(losses) | ($2,717,988) | ($2,879,202) | ||

| Unrealized Security Gains/(losses) | ($8,293,537) | $7,004,017 | ||

| Income Tax Expense | $607,867 | $4,242,069 | ||

| Net Income | $4,923,172 | $17,423,671 |

Loan Mix: 77% Residential Mortgage | 19% Commercial Mortgage | Commercial 3% | Consumer 1%

Team Member Graduations, Honors, and Awards

2022 Launch Management Training Graduates – Kleopatra Curis, Sarah Duval, Heather Gumlaw, June Holaday, Rebecca Jacoinski, Edwin Lobo, Tristan Mallinson, Roberto Robles, Vincenzo Denniston, Pratima Shah

Chamber of Commerce of Eastern Global Leadership Program 2022 graduates – Penni Harlow, Mario Siciliano

Global School of Finance and Management 2022 graduates – Ana Healy

New England Leadership Development Program 2021 Graduates – Kelly Allard, Melinda Burridge, Chrissy Caplet

Greater Norwich Area Chamber of Commerce LEAD Program 2022 Graduates – Renee Simao, Tori Thomas

Global Bankers Association (CBA) “New Leaders in Banking” – Jean McGran, Kelly Allard

ICBA Independent Banker’s “40 under 40” – Alexis Kahn

The George W. Strouse ‘Spirit’ Award – Alexis Kahn, Kristin Zummo

Forte Award – Nicole Goodrow, Carleen Lee, Cia Malahias

Officer promotions

Anthony Joyce – Chief Executive Officer

Kristin Zummo – Senior Vice President

Marie Carmenati – First Vice President

Barb Curto – First Vice President

Alexis Kahn – First Vice President

Matt Morrell – First Vice President

Bill Mundell – First Vice President

Harry Colonis – Vice President

Jennifer Eastbourne – Vice President

Mario Siciliano – Vice President

Marielle Winkelman – Vice President

June Holaday – Assistant Vice President

Jason Levine – Assistant Vice President

Damen Norton – Assistant Vice President

Elizabeth Owen – Assistant Vice President

Jennifer Willingham – Assistant Vice President

Nicole Goodrow – Assistant Treasurer

Becky Jacoinski – Assistant Treasurer

Megan Susi – Assistant Treasurer

Krissa Beene – Assistant Secretary

Christen Brewer – Assistant Secretary

Rebecca Dambach – Assistant Secretary

Heather Gumlaw – Assistant Secretary

Lisa Lamphere – Assistant Secretary

Christine Lataille-Santiago – Assistant Secretary

Leadership Team

Anthony Joyce, III – President and Chief Executive Officer

Lori Dufficy – Executive Vice President, Chief Experience and Engagement Officer

Alex Masse – Executive Vice President, Chief of Operations & Innovation

Michael Sheahan – Executive Vice President, Chief Lending Officer

Jessica Todd – Executive Vice President, Chief Financial Officer

Katherine Allingham – Senior Vice President, Chief Risk and Compliance Officer

Richard Balestracci – Senior Vice President, Commercial Lending Department Manager

John Uyeki – Senior Vice President, Director of Financial Services

Larry Walker – Senior Vice President, Director of Technology

Anne Wilkinson – Senior Vice President, Chief Human Resources Officer

Kristin Zummo – Senior Vice President, Director of Strategy and Organizational Development

FIRST VICE PRESIDENTS

Kelly L. Allard – First Vice President, Loan Servicing and Lending Compliance Manager

Kathryn Alves – First Vice President, Credit Department Manager

Marie Carmenati – First Vice President, Retail Lending Underwriter Manager

Barbara Curto – First Vice President, Marketing Manager

Tamela D. Higgins – First Vice President, Human Resources Manager

Jean McGran – First Vice President, Member Experience Market Manager

Alexis Kahn – First Vice President, Cash Management Sales Manager

Matthew Morrell – First Vice President,Retail Lending Sales Manager

William Mundell – First Vice President, Digital Banking Channel Manager

VICE PRESIDENTS

Melinda M. Burridge – Vice President, Regional Sales and Service Manager

Christina M. Caplet – Vice President, Operations and Security Manager

Harry Colonis – Vice President, Business Development Officer

Jennifer L. DeLucia – Vice President, Controller

Sarah A. Dion – Vice President, Internal Audit Manager

Jennifer Eastbourne – Vice President, Financial Services Program Coordinator

James M. Elliott, CFP – Vice President, Financial Advisor

Robert R. Fradette, CFP – Vice President, Financial Advisor

Beth Glynn – Vice President, Retail Loan Originator

Dawn M. McGinnis – Vice President, Loan Compliance and Acquisition Administrator

James J. McGuinness – Vice President, Commercial Loan Officer

Nancy Murphy – Vice President, Data Governance Manager

Paulette A. Retsinas, CFP – Vice President, Financial Advisor

Dawn Sandvoss – Vice President, Commercial Loan Officer

Mario Siciliano – Vice President, Technology Operations Manager

Marielle Winkelman – Vice President, Regional Sales and Service Manager

ASSISTANT VICE PRESIDENTS

Matthew Benoit – Assistant Vice President, Project Management Specialist

Ishmael D. Bryan – Assistant Vice President, Collection Manager

Dana S. Chapel – Assistant Vice President, Customer Solutions Manager III

Craig Cuffie – Assistant Vice President, Retail Lending Underwriter II

Lisa M. Fields – Assistant Vice President, Facilities Manager

Vira Fiore-Labrecque – Assistant Vice President, Customer Care Center Manager

Maria Grenier – Assistant Vice President, Deposit Operations Manager

Penni Harlow – Assistant Vice President, Customer Solutions Manager III

Michael Hawes – Assistant Vice President, Commercial Loan Officer

June Holaday – Assistant Vice President, Assistant to the President

Yana E. Kozleva – Assistant Vice President, Senior Auditor

Jason Levine – Assistant Vice President, Technical Services Specialist II

Sara Lundy – Assistant Vice President, Compliance Manager

JoAnn Lynch – Assistant Vice President, Customer Solutions Manager I

Rebecca Magner – Assistant Vice President, Customer Solutions Manager III

Kelly Meakem – Assistant Vice President, Digital Banking Operations Manager

Regan Nichols – Assistant Vice President, Customer Solutions Manager III

Damen Norton – Assistant Vice President, Lending Compliance & Encompass Administrator

Elizabeth Owen – Assistant Vice President, Lead Senior Credit Analyst & Sageworks Administrator

Karen S. Stearns – Assistant Vice President, Retail Branch Lending Specialist

Donna L. Thompson – Assistant Vice President, BSA Manager

Richard J. Turner – Assistant Vice President, Retail Loan Originator

Jennifer Willingham – Assistant Vice President, Cash Management Officer

ASSISTANT TREASURERS

Giusy Beaman – Assistant Treasurer, Branch Operations Manager

Mandy-Lyn Crispim – Assistant Treasurer, Customer Solutions Manager II

Sarah Duval – Assistant Treasurer, Risk Management Specialist

Nicole Goodrow – Assistant Treasurer, Customer Solutions Manager II

Ana Healy – Assistant Treasurer, Retail Administrator and Skills Coach

Rebecca Jacoinski – Assistant Treasurer, Benefits and Wellness Specialist

Carleen M. Lee – Assistant Treasurer, Customer Solutions Manager I

Michele Magowan – Assistant Treasurer, Retail Lending Sales Specialist

Kristen S. Scott – Assistant Treasurer, Customer Solutions Manager II

Renee Simao – Assistant Treasurer, Talent Acquisition Specialist

Megan Susi – Assistant Treasurer, Customer Solutions Manager I

ASSISTANT SECRETARIES

Marta Amor-Baker – Assistant Secretary, Retail Loan Originator

Krissa Beene – Assistant Secretary, Marketing Specialist

Christen Brewer – Assistant Secretary, Graphic Design and Digital Specialist

Rebecca Dambach – Assistant Secretary, Loan Delivery & Quality Control Analyst

Jamie Goulas – Assistant Secretary, Retail Loan Originator

Miria Gray – Assistant Secretary, Community Education Officer

Heather Gumlaw – Assistant Secretary, Loan Servicing Assistant Manager

Lisa Lamphere – Assistant Secretary, Commercial Lending Assistant

Christine Lataille-Santiago – Assistant Secretary, Human Resources Specialist

Linda M. Kosta – Assistant Secretary, Commercial Lending Assistant

Timothy Rich – Assistant Secretary, Financial Analyst

Lauren Vincent – Assistant Secretary,Small Business Loan Officer

Anthony Joyce, III – President and Chief Executive Officer, Nebula Trust Bank

Ben Benoit – President, PCW Management Center, LLC

Betsy Conway – Legal Consultant, Mashantucket Pequot Tribal Nation

Patrick L. Green FACHE – President and CEO of L&M Healthcare and Executive Vice President of Yale New Haven Health

Mary Ellen Jukoski, Ed.D. – President, Three Rivers Community College

Kimberly Cardinal Piscatelli – Owner and Dealer Manager of Cardinal Honda

B. Michael Rauh, Jr. – Retired President and CEO, Nebula Trust Bank

Thomas Switz – President, Switz Insurance and Real Estate

Seymour Adelman

Dr. Michael Alfultis*

Louis E. Allen, Jr.

Alexis Ann

Carl Banks*

Edward Bartelli

D. Ben Benoit

Wilfred J. Blanchette Jr.

Mark E. Block

Richard E. Blodgett Jr.

Ellen C. Brown

Allyn L. Brown III

Wendy Bury

Rodney Butler

Leo E. Butler, Jr.

Pietro Camardella

Dennis J. Cambria D.D.S.

Stanley A. Cardinal*

Kimberly Cardinal

Dr. Steven B. Carlow

Cynthia J. Casey

Stephen Coan

John A. Collins, III

Fred A. Conti

Elizabeth Conway

Valerie Cordock

Lori Danis

Abby I. Dolliver

Irene Donovan*

Michael E. Driscoll

Maryam Elahi

David P. Erskine

Tracy Espy

Ralph G. Fargo*

Gary Farrugia

Peter S. Gianacoplos

Denison N. Gibbs

Scott Gladstone

Robert H. Glass Jr.

Jeffrey R. Godley

Michael A. Goldblatt

Mark Grader*

Patrick Green

Ulysses B. Hammond

Donna Handley

Theodore A. Harris

Leah A. Hartman

Shiela Hayes

Thomas M. Hinsch

Cathleen J. Holland

Peter Hoops

Richard M. Hoyt Jr.

John J. James

Eric M. Janney

Christopher R. Jewell

Margarett L. Jones

Dr. Mary Ellen Jukoski

Nicholas F. Kepple

Pamela A. Kinder

Jon T. Kodama

Robert V. Krusewski*

Theodore M. Ladwig

Suki Lagrito

P. Michael Lahan

Christopher B. Lillibridge

Edwin Lorah

Jennifer J. Lowney, DMD

Paul V. Mathieu

Jeffrey A. McNamara

Daniel Meiser

Santa Mendoza

Wilhelm W. Meya

Theodore S. Montgomery*

Dr. Naomi Nomizu

Mark R. Oefinger

Andrew C. Pappas

Patricia A. Pastor

B. Michael Rauh

Felix Reyes

Larry J. Rivarde

Caleb Roseme

Samanta Roseme

Lottie B. Scott

Meagan E. Seacor

Dina Sears-Graves

Jonathan Shockley

John M. Smith*

William A. Stanley

Kathleen Stauffer

Kathleen A. Steamer*

Thomas R. Switz

Robert W. Tabor

Laurelle Texidor

William F. Turner

Robert A. Valenti

Edward J. Waitte

David A. Whitehead

Adam Young

Catherine L. Young

*Corporator Emeritus