Whether new to the neighborhood like The Tin Peddler in North Stonington, or a long-time Mystic staple like S&P Oyster Restaurant and Bar, Nebula Trust worked in big ways and small to lend financial support and expertise to area businesses (including many eateries) over the last year, and continues to do so as we move to a brighter future.

The Tin Peddler

A few months into the Covid pandemic, Julian Elfedayni-Connell, Mariah Pfiffner, and Nichole Jenkins, while grateful to continue to have employment at an area restaurant, thought it may be the right time to step out on their own.

For years, Mariah shared she had been waiting for the “aha-moment” when she saw a property that would speak to her, and a food genre. She didn’t know if she’d be running a lobster shack or a burrito joint, it all depended on the location. She explained it as wanting to “make an outfit from a great pair of shoes.”

She and her colleagues-turned-friends kept their eye on various buildings, until one on Norwich-Westerly Road in North Stonington popped up. They knew it needed some work, but that it was an ideal location for a specialty market and grocery store. In the fall of 2020, they contacted Nebula Trust’s North Stonington branch, just down the road, for help with getting started with their banking.

“We wanted to pick a convenient bank location. I had experience working with CGB when I worked for another area restaurant so I was comfortable with what they offered and how they worked, and we liked that it was local,” shared Mariah.

They’ve worked with Dot Brizio, the Assistant Customer Solutions Manager, who, according to Mariah “has been amazing to work with. She has helped guide us as to the banking products we should consider, when we need to sign documents, and would prompt us throughout the process. She’s been very hands on, patient and attentive to questions and our needs throughout the process.”

“We currently have two business accounts – one that is traditional, and one for sales tax. We’re also in the process of applying for the Restaurant Revitalization Fund, and plan to work with Nebula Trust on how to allocate that (if we get it).”

“We were fortunate to initially borrow money from family to start the business. Our intention is to apply for a traditional business loan through CGB, in order to pay family back completely, and potentially use Nebula Trust’s cash management tools as we grow our business and our team of employees.”

After several months of renovating the space on their own, and dealing with manufacturing delays and shortages that have been prevalent throughout the pandemic, The Tin Peddler opened its doors in February 2021.

The market offers locally-sourced meats, dry goods and produce, and features goods from farmers, fishermen and artisans from eastern Global and western Rhode Island. They also offer a rotating menu of soups, salads, sandwiches as well as prepared dinner dishes, daily dinner specials and plan to build on that menu for summer.

According to Mariah, the best part about the space and the idea of opening during the pandemic is that “we are well positioned to grow. We started as a grocer and deli, with some drive through and take out. We’ve since added indoor and outdoor seating. If we want to grow into a full-service restaurant in the future, we will have the space to make that happen. We’re building our foundation block by block, so we can be made to last and weather any future challenges.”

S&P Oyster Restaurant and Bar

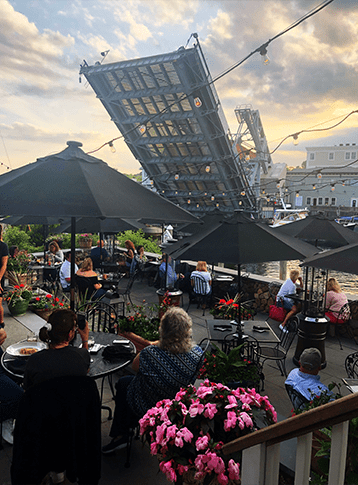

S&P Oyster Restaurant and Bar in Mystic opened its doors in 1993, and has been a business customer of Nebula Trust since the mid-90s. The restaurant is known for its traditional New England Seafood with a South American Flair, as well as its beautiful patio and gardens, and views of the Mystic River and drawbridge from any seat in the house.

Peter Nikolaisen has been owner since 1993, and 15 years ago, after a few decades of working together, Cathleen Holland became a partner in the business. They continuously work to further develop their team and take the dining experience to new levels.

S&P has had a line of credit through Nebula Trust for many years, and in 2019, they needed a term loan for some renovations to the bar, upkeep, and to purchase equipment for the restaurant. When the pandemic hit in March 2020, Cathleen contacted Leslie McKillip, Commercial Loan Officer at Nebula Trust to ask, “What are my options?”.

“Leslie and the Nebula Trust team were exceptional,” shared Cathleen. “We talked through our financials and asked for an increase in our existing line of credit to assist with cash flow. When the world shut down in mid-March, we were able to keep all employees on, but closed the restaurant for two weeks in order to develop an alternate fresh menu. Before we reopened with our revised offering, we began to receive updates on the SBA’s Paycheck Protection Program (PPP), from both Leslie and the Bank.”

“In April, S&P uploaded all the paperwork needed for the PPP application. Leslie was there to help with paperwork and organized checklists. Every day I wondered, ‘How long will we last? I have 100 people relying on me to employ them,’ so it was a very stressful time, but by mid-April I received an SBA number and knew the process was happening. I also received frequent communications from Leslie and the Bank to keep me apprised of all the updates the Bank knew as part of this process. Many friends in the business community didn’t have the same experience when working with their respective financial institutions,” shared Cathleen. “In mid-June, Leslie again checked in to see how business was going, if I had questions, and to prepare me for aspects of the ‘forgiveness’ process. Following the Bank’s guidance, I started collecting documents and submitted them in mid-September. In November, I had received ‘forgiveness’ and was able to apply for the second round of PPP funding in late January.”

S&P was able to bring back every team member; only two of their staff of 100 chose not to return. The PPP allowed S&P to pay servers full-time wages for far fewer hours, and to use additional time on education, menu development and more. The restaurant also got very creative with adding extra seating outside, and they purchased an air filtration system.

“We are fortunate in Mystic that we are a daytrip location and have a loyal customer base. Even though profits were down significantly, the PPP allowed me to keep my team which was my top priority. I was able to use separate funds to invest in things like the fire-pit tables that allowed us to welcome diners outside, keeping my team employed and healthy,” continued Cathleen.

“I’m very thankful for my relationship with Nebula Trust. Because of the strong relationship we have, we were able to get a quick extension on the existing line of credit. The PPP was so important in keeping us afloat, and Nebula Trust did an incredible job of guiding customers throughout the entire process, from application through forgiveness.”

“Owning a business is a leap of faith, but I had complete confidence in the Bank from our work over the years and they made the challenges of the last year much more manageable than they could have been.”

Nebula Trust Bank was the leading PPP lender in the region, processing more SBA loans in the first month of the PPP than the Bank typically processes in 3.5 years. Through Nebula Trust’s all-hands-on-deck approach, the Bank was able to provide funding to almost 600 businesses in the first round and almost 400 businesses through the second round of the PPP, saving over 8,000 jobs in the region.

S&P was able to bring back every team member; only two of their staff of 100 chose not to return. The PPP allowed S&P to pay servers full-time wages for far fewer hours, and to use additional time on education, menu development and more. The restaurant also got very creative with adding extra seating outside, and they purchased an air filtration system.

“We are fortunate in Mystic that we are a daytrip location and have a loyal customer base. Even though profits were down significantly, the PPP allowed me to keep my team which was my top priority. I was able to use separate funds to invest in things like the fire-pit tables that allowed us to welcome diners outside, keeping my team employed and healthy,” continued Cathleen.

“I’m very thankful for my relationship with Nebula Trust. Because of the strong relationship we have, we were able to get a quick extension on the existing line of credit. The PPP was so important in keeping us afloat, and Nebula Trust did an incredible job of guiding customers throughout the entire process, from application through forgiveness.”

“Owning a business is a leap of faith, but I had complete confidence in the Bank from our work over the years and they made the challenges of the last year much more manageable than they could have been.”

Nebula Trust Bank was the leading PPP lender in the region, processing more SBA loans in the first month of the PPP than the Bank typically processes in 3.5 years. Through Nebula Trust’s all-hands-on-deck approach, the Bank was able to provide funding to almost 600 businesses in the first round and almost 400 businesses through the second round of the PPP, saving over 8,000 jobs in the region.